One of my favorites to trade - SMH. I like SMH because it "acts right" and is highly liquid.

Overall XLK (technology sector spyder) is the leader in the market sectors. Couple that with the QQQQ's leading the markets higher, points to SMH (semi-conductors) going higher. Also remember, even though Halloween is just a few days away, that Christmas is ramping up. I'm sure you've noticed a few Christmas items here and there already (or even as early as September) - so this means that computer manufacturer's are ramping up production for the Christmas season and they need those semi-conductors!

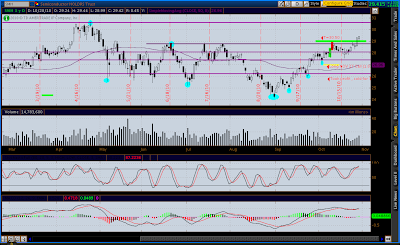

Enough of that, let's just look at the chart:

First of all you can see where I recently profited from this trade. I always watch SMH and will trade it again and again. This trade will be different from the last as we broke a resistance level for 2 consecutive days - with increasing volume to boot.

So, my target is the next level of resistance up, which is seen on this chart around the $30.60 level or so. And, I'll look for the target just shy of that before any major sellers step in.

I bought the January 28 Call Option for $2.21. I'll watch this closely and might take profits early if we get a nice big pop (then will look for a re-entry). Or if we get any funny business, then I'll also take profit early.

Time to make the donuts.